Mortgage Rates After Fed Hikes by 0.75% (What this means for FUTURE mortgage rates)

As expected, The Federal Reserve announced a rate hike of 0.75%. But don’t think that the Federal Reserve rate hikes will move mortgage rates higher. What most people don’t realize is that the Federal Reserve does not directly hike or cut mortgage rates. The only exception for the Fed setting mortgage rates directly would be certain lines of credit that are based on the PRIME rate. This is a vast minority of the mortgage market and nothing to do with the dominant 30yr fixed loan. The Fed Funds Rate is a target set by the Federal Reserve for interest charged by big banks to lend money to each other on an overnight basis. The Federal Reserve Fund Rate pertains to loans that last 24 hours or less, the market decides what longer term loans will cost.

I spoke to Frank Lillo, Sr. Loan Originator at Pharus Home Mortgages LLC and Frank tells us that

“No one has a crystal ball, but there’s no reason to believe that the current leadership will make a hard turn to right the ship, so the balance of 2022 is more likely to be more of the same.”

I asked Frank what should Buyers, Sellers, and Investors do.

“For Buyers, if a buyer can qualify to buy a house they like as their primary residence, even with the higher interest rates, it probably makes sense to do so. Compared to the high cost of renting in this market, there’s usually a financial advantage to owning. build some equity and enjoyed the “pride of ownership”.

“For sellers, demand is still pretty good so those offers will still come in, just not 20% over asking price as had been the norm in the past six to eight months. And isn’t that what you would have expected in a normal market anyway?”

“For investors, it’s always about the numbers, so if the numbers work ( ROI, Cap Rate, etc ), then you’ve got a workable deal. Rates go up, rents go up, it mostly washes out.”

To learn more about mortgage options or speak to Frank Lillo of Pharus Home Mortgages click here.

What’s next for mortgage rates?

With the demand for purchasing homes on the decline, high home prices, decreasing consumer confidence, and previous mortgage rate increases I believe that mortgage rates will stay steady but will have fluctuation.

To learn more about mortgages or contact a Real Estate concierge click here.

Top Rated Real Estate Broker

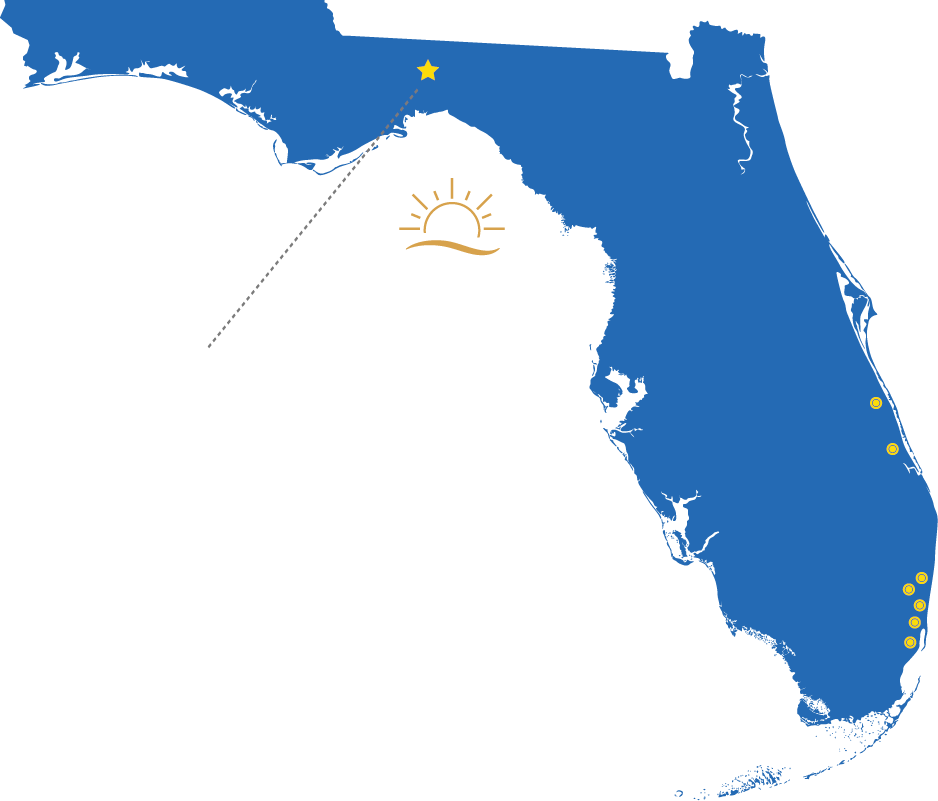

Real Estate Markets:Tallahassee, Plantation, Davie, Cooper City, Pembroke Pines, Weston, Sunrise, Fort Lauderdale, Boca Raton, Port St. Lucie and Vero Beach Florida.