Top 6 Breaks and Deductions with Joe Jennings, Your Expert in Real Estate Investment Strategies

In the dynamic landscape of real estate investing, understanding the tax benefits associated with your portfolio is crucial for maximizing returns. In this blog post, we’ll explore the top six tax breaks and deductions in real estate investments. Join Joe Jennings, an expert in real estate investment strategies at Sunny & Associates Realty, as he guides you through the intricacies of leveraging tax advantages to optimize your investment strategy.

For detailed information on IRS guidelines for real estate tax write-offs, visit the official IRS web page here.

1. Real Estate Tax Write-Offs: A Foundation for Savings:

With a wealth of knowledge in real estate investment, Joe Jennings ensures you make the most of every tax-saving opportunity. From mortgage interest deductions to property tax write-offs, Joe’s expertise guides you in capitalizing on these foundational benefits.

2. Depreciate Costs Over Time: A Long-Term Advantage:

As your expert in real estate investment strategies, Joe Jennings navigates the strategy of depreciating costs over time. Learn how this long-term advantage can significantly contribute to your overall tax savings while maintaining a steady income stream.

3. Use a Pass-Through Deduction: Optimizing Income Flow:

Joe Jennings simplifies the complexities of pass-through deductions, providing insights on how to optimize your real estate investments for maximum income while minimizing tax liability. Explore Joe Jennings’ strategies for optimizing income flow through pass-through deductions on his investing web page here.

4. Take Advantage of Capital Gains: Strategic Wealth Accumulation:

Guided by Joe Jennings, your expert in real estate investment, discover strategies to leverage capital gains for strategic wealth accumulation. Benefit not only from property appreciation but also from favorable tax treatment on your gains.

5. Defer Taxes With Incentive Programs: Strategic Planning for Long-Term Success:

Unlock the secrets to deferring taxes through incentive programs with Joe Jennings’ strategic guidance. Reinvest and compound your returns over time while strategically managing your tax obligations.

6. Be Self-Employed Without the FICA Tax: Unlocking Entrepreneurial Opportunities:

Explore how Joe Jennings, your expert in real estate investment strategies, guides investors in embracing self-employment without incurring the FICA tax burden. Gain insights into this strategy and its alignment with your long-term financial goals. Unlock entrepreneurial opportunities and be self-employed without the FICA tax with Joe Jennings’ guidance on his investing web page here.

Conclusion: Real Estate Investment Strategies

Partnering with an expert in real estate investment strategies like Joe Jennings is key to navigating the tax benefits associated with your investments. Joe ensures that you not only build a robust portfolio but also strategically leverage tax breaks to enhance your overall financial position. For a personalized consultation on optimizing your real estate investment strategy, contact Joe Jennings at Sunny & Associates Realty. Unlock the full potential of your investments and navigate the world of real estate with confidence and strategic acumen.

For more details on Joe Jennings’ expertise and how he can help you optimize your real estate investments, visit his investing web page here.

For detailed information on IRS guidelines for real estate tax write-offs, visit the official IRS web page here. https://www.irs.gov/publications/p527

Joe Jennings Broker, Sunny & Associates Realty

Contact Information:

- Phone: 772-828-7989 or 954-982-4842

- Email: [email protected]

- Web: Contact Form

Top Rated Real Estate Broker

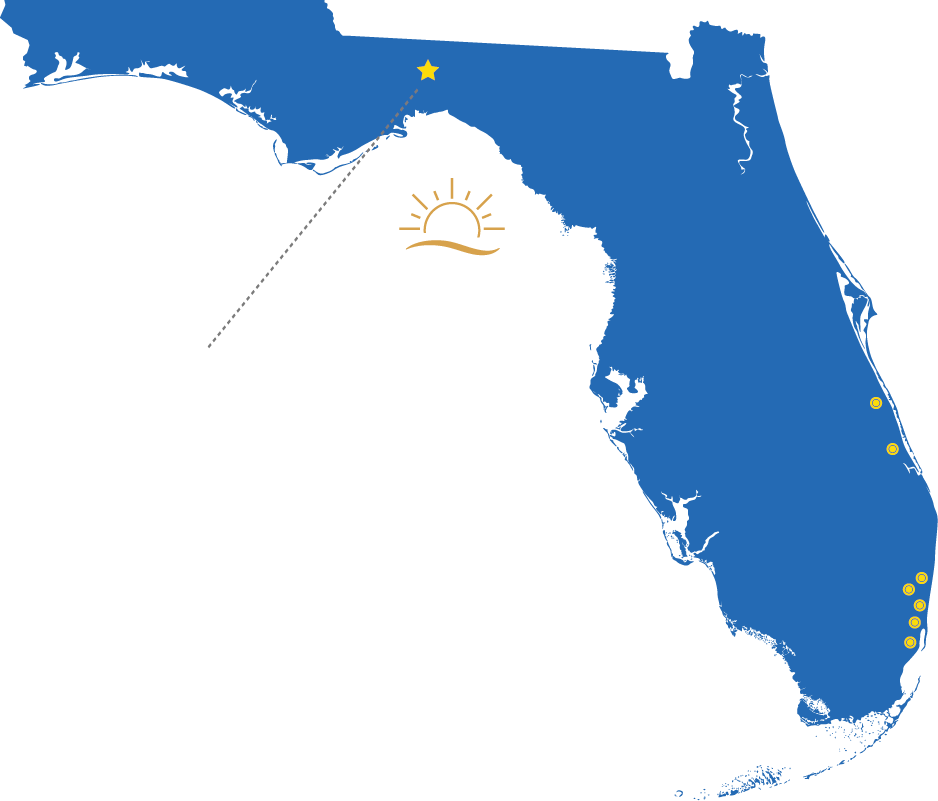

Real Estate Markets:Tallahassee, Plantation, Davie, Cooper City, Pembroke Pines, Weston, Sunrise, Fort Lauderdale, Boca Raton, Port St. Lucie and Vero Beach Florida.